Content

Using AR has several benefits, including improved cash flow management, reduced risk of bad debts, and improved customer relationships. It also provides a clear record of all the business’s assets which is useful when preparing financial statements. With the cash-basis accounting method, a company records expenses when it actually pays suppliers.

The goal of the AP process is to ensure legitimacy and accuracy of any payment originating from the business to any supplier/vendor. Since manual invoice processing is vulnerable to exploitation, automating the accounts payable process can minimize the risk of fraud. Automation also helps to ensure that all payments are made accurately and according What Is Accounts Payable? to predefined criteria. This reduces the risk of fraudulent activities such as misappropriation of funds, duplicate payments, and phantom vendors. Accounts payable is a crucial part of your company’s financial statement. It likely makes up the majority of your business’s outgoing cash, for expenses like bills and payments to vendors.

Connect With a Financial Advisor

OCR technology converts text into machine-readable data by recognizing characters. One type of external fraud that can jeopardize your company is vendor invoice fraud. This type of fraud occurs when a fraudster submits an invoice for payment, claiming to have provided goods or services to your company. The invoice may be for a legitimate service or product, but the price may have been inflated or the vendor may have charged for goods or services that were not actually provided.

- This means that accounts payable must be processed exactly in accordance with a strict procedure that is followed in exactly the same way, every time.

- After this is accomplished, the invoices must go through the company’s respective business process in order to be paid.

- However, if your company uses accounting software this recording process is done automatically by scanning the invoice.

In general, accounts payables are considered short-term liabilities, since they are normally expected to be paid within a year or less. However, the specific terms of payment for accounts payables can vary depending on the agreement between the company and its suppliers. Some suppliers may offer longer payment terms, while others may require payment on delivery or within a shorter time frame.

Drawbacks of the traditional account payable process

A company’s Accounts Payable department tracks the amounts owed and records them as short-term obligations on the general ledger. They are also responsible for keeping these records up-to-date and ensuring that invoices get paid by the payment date. A paper-based AP process crawls at a snail’s pace compared to accounts payable automation.

The efficiency and effectiveness of the accounts payable process will also affect the company’s cash position, credit rating, and relationships with its suppliers. When a company orders and receives goods in advance of paying for them, we say that the company is purchasing the goods on account or on credit. The supplier of the goods on credit is also referred to as a creditor. If the company receiving the goods does not sign a promissory note, the vendor’s bill or invoice will be recorded by the company in its liability account Accounts Payable .

The Skill You Need to Screen for When Interviewing AP

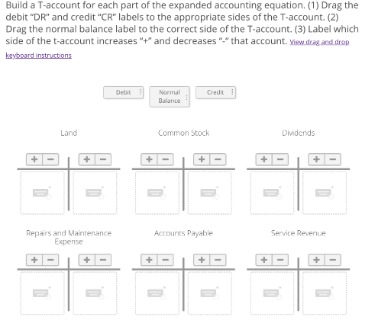

In addition to recording invoices and contracts, an accounts payable department is responsible for recording expenses incurred during the company’s internal operations. For example, if a company purchases goods for $780, it will record a $780 credit under accounts payable, and a $780 debit to the expense account. Once the company has paid the invoice, it will debit accounts payable by $780, and record a $780 credit to cash.

- For example, if a company purchases goods for $780, it will record a $780 credit under accounts payable, and a $780 debit to the expense account.

- This is because we are recognizing that we paid less for the inventory that we received.

- As A already pays $15,000, the invoice received from Company B deducts the same from the total due amount.

- Also, it reduces the need for paper and other physical documents, which decreases the cost of supplies and storage.

- This problem is compounded when invoices that require processing are on paper.

- The main goal of the accounts payable process is to ensure timely, accurate, and secure payments to creditors.

- It records the goods and services a business has provided its customers but has yet to receive payment for.

The increased frequency helps small businesses take advantage of any early-payment discounts included on invoices and resolve credits due to inventory returns. Accounts payable is money owed by a business to its suppliers to vendors and suppliers for goods that https://kelleysbookkeeping.com/ have not been paid for. The term AP is often used to describe a function within a business that is focused on processing payments for suppliers and vendors. Some suppliers provide early payment discounts if a company settles an invoice sooner than the due date.

Looking to automate your payables and receivables?

Typically, current liabilities are short-term liabilities and less than 90 days. Each responsibility of the accounts payable team helps to improve the payment process and ensure payments are only made on legitimate and accurate bills and invoices. A knowledgeable and well-managed accounts payable department can save your organization considerable amounts of time and money with regard to the AP process.

While related, expenses include all costs related to business operations, while accounts payable focus on obligations a business has to suppliers, vendors, debtors, and creditors. Accounts payable records the money your business plans to pay to third parties, while expenses include the costs necessary for business operations, including utility payments and payroll. As an important indicator of the health of a business, accounts payable is a gauge of cash flow. Properly managing the accounts payables process ensures consistent and accurate financial information, while also supporting strong business relationships with vendors and suppliers. Accounts Receivable in accounting refers to the money a business is owed by its customers.